How to Break Out of Our Long National Tax Nightmare

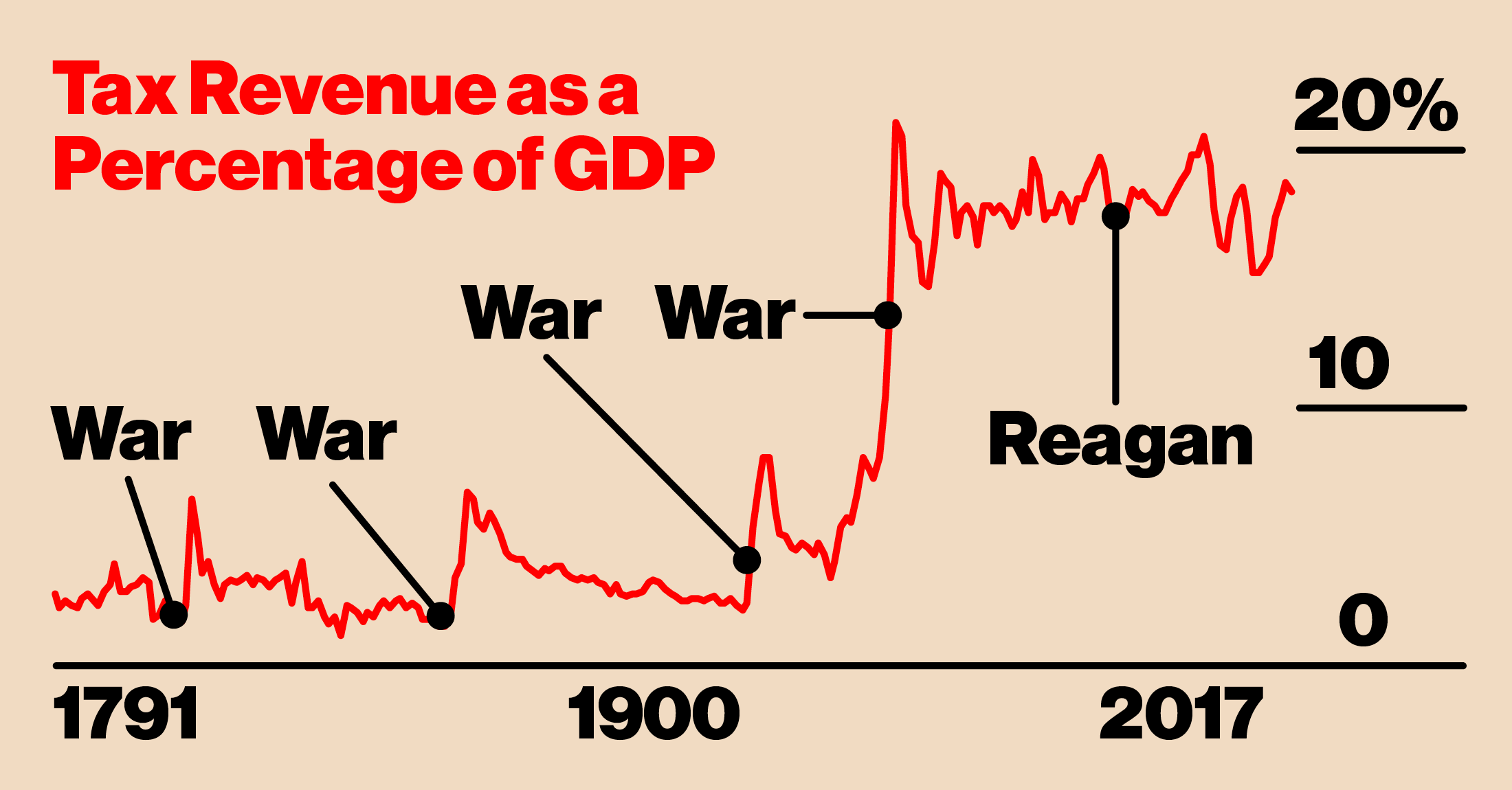

Data: Historical Statistics of the United States, MeasuringWorth, Office of Management and Budget

President Donald Trump wanted to call it the Cut Cut Cut Act. Congressional Republicans settled on the less catchy and no more descriptive Tax Cuts and Jobs Act. What the legislation that began making its way through the U.S. House of Representatives in early November actually would do is sharply reduce taxes for business while rearranging the personal income tax with a mix of cuts and increases. House Speaker Paul Ryan called the bill “a game changer for our country.” The president said it was “the rocket fuel our economy needs to soar higher than ever before.”

That’s a lot to expect from some changes in the tax code. But then, here in the U.S. we’ve come to expect big things of our income taxes. On the right, cutting them has been portrayed for decades as a near-magical growth elixir. On the left, raising or rearranging them is seen as essential to making society fairer. And across the political spectrum, economic and social policies have come to rely on carving credits, deductions, and other exceptions out of the tax code to favor this or that behavior.