WeWork Wants to Become Its Own Landlord With Latest Spending Spree

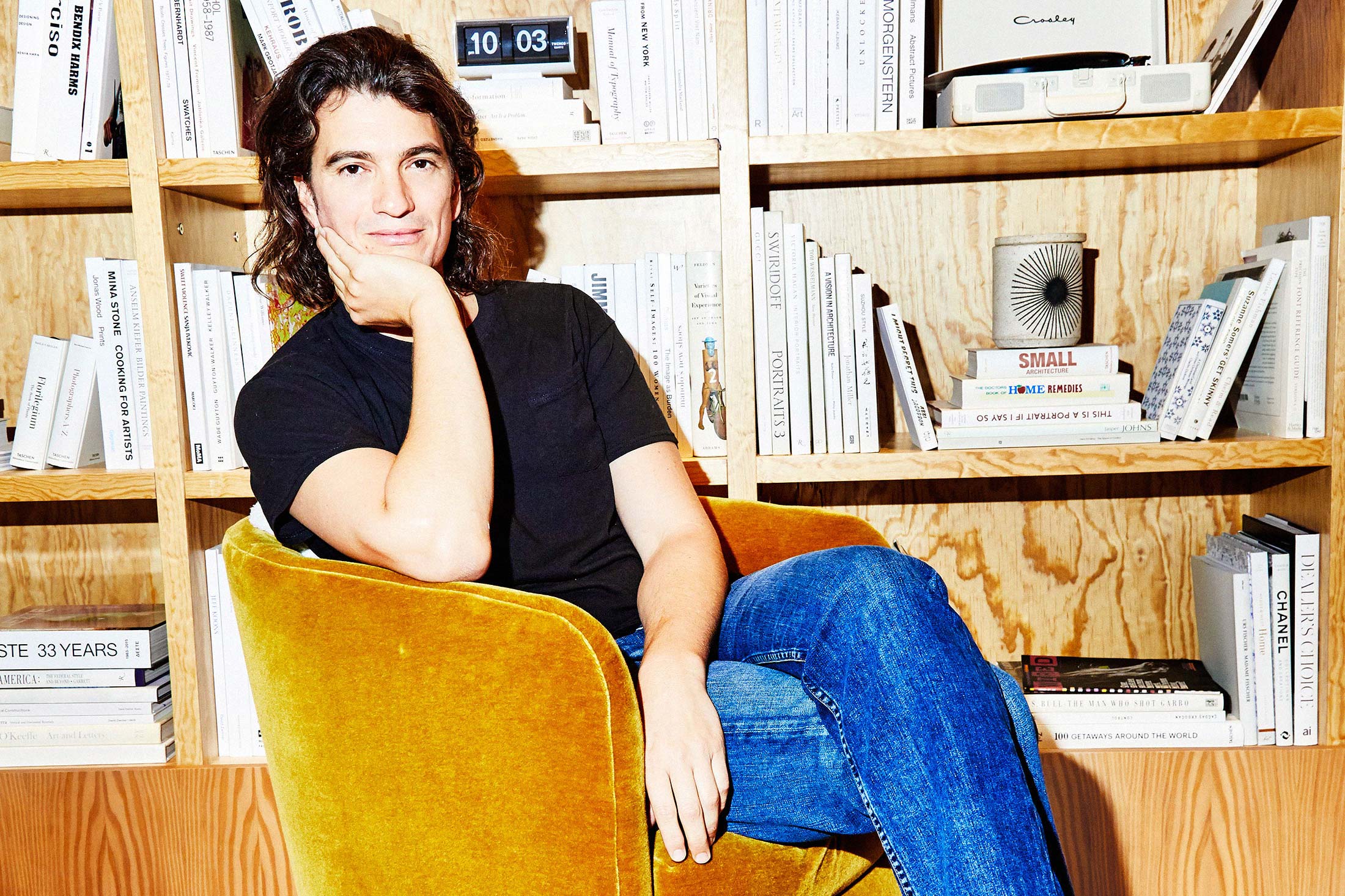

WeWork CEO Adam Neumann at a company workspace in New York.

Photographer: Amy Lombard for Bloomberg BusinessweekAdam Neumann runs one of the few startups on Earth for which $2 billion of fresh funding was, or ever could be, terrible news. Just before last Christmas, Masayoshi Son, Neumann’s most important investor, called to say that was his final offer and that their negotiations over an additional $16 billion for Neumann’s WeWork were over. Shares of Son’s SoftBank Group Corp. stock had dropped sharply a few days earlier along with the rest of the stock market, and Son had decided the $8.5 billion he’d already invested wasn’t worth more than doubling, even to take a majority stake. With a cash infusion almost an order of magnitude less than it had expected, WeWork Cos. would have to figure out on its own how to stop losing $1.9 billion a year.

That flip-flop revived questions about what exactly the office-space-renting startup is and how it should be seen. Son made the call because the biggest investors in SoftBank’s $100 billion Vision Fund didn’t want to be so exposed to a single real estate company, according to people familiar with his thinking. SoftBank didn’t respond to a request for comment. Neumann says the reversal was understandable given the momentary market freakout and that it’s tough to get too annoyed at the guy who’s given you a grand total of $10.5 billion. “They’re very nice people,” he says.