The Simple Problem That Sank Greensill’s Complex Financial Empire

The former fintech darling took in money from investors seeking safety and used it for risky loans. It all collapsed in a crisis of confidence.

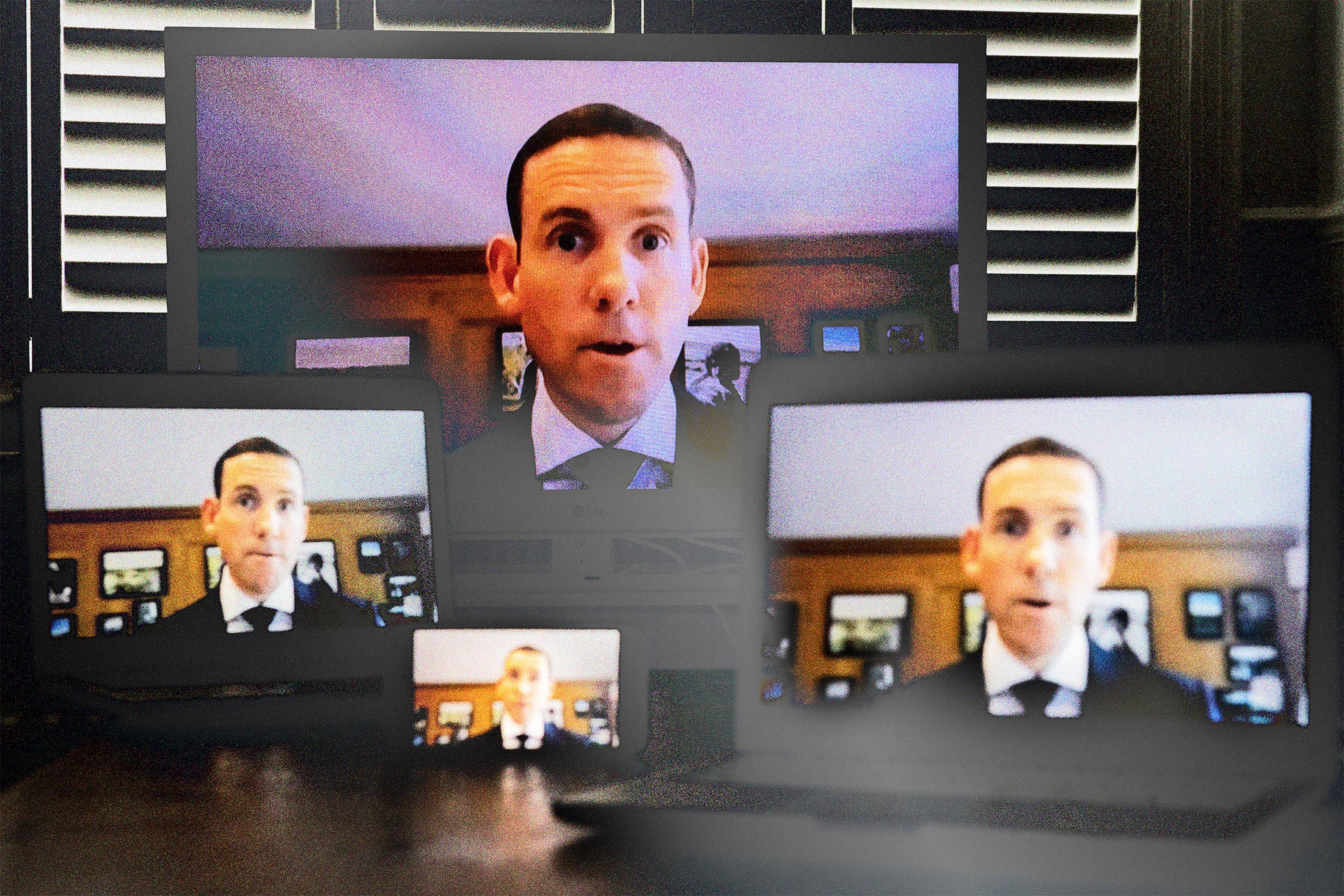

Greensill Capital CEO Lex Greensill during a livestream of a select committee hearing in Parliament into the collapse of his company, on May 11.

Photographer: Chris J. Ratcliffe/BloombergEvery company has a genesis story, a tale to give customers and investors something simple to latch onto, even when the business is new or hard to understand. Tech pioneer Hewlett-Packard was started by a couple of electronics tinkerers in a garage. EBay, on its way to introducing the idea of online auctions, had a (made-up) yarn about someone looking for a better way to collect Pez dispensers. Theranos peddled its (allegedly made-up) finger-prick blood test technology with a story about founder Elizabeth Holmes being afraid of needles as a child.

Greensill Capital had the melon farm. Lex Greensill, founder and chief executive officer of the London-based lender that proclaimed it was “making finance fairer,” loved regaling anyone within earshot about his parents scratching out a living in the flatlands around Bundaberg, Australia. A good harvest of melons and sugar cane meant fat times, but a dry year could wreak havoc. Just as stressful were the monthslong delays in payments from customers, leaving the family short of cash. In Greensill’s telling, his company had come up with a way to help small businesspeople like his parents get their money faster.