Where to Invest $100,000 Right Now

Five experts share their best ideas on where to put your money in this unsettled market.

As a volatile 2022 comes to a close, recession talk has many investors in a defensive crouch.

In the short term, it may make more sense to focus on preserving capital than finding growth. But in the long run, inflation eats away at cash and leaves savers with less purchasing power.

For those willing to venture into the markets, we asked five investment experts to share their best ideas on where to invest $100,000. Their picks ranged from private credit to global small-cap stocks to larger “quality value” plays. When asked about investing in something more tangible, answers ranged from watches and historical artifacts to buying a five-figure drum set.

For investors who like to use exchange-traded funds, Bloomberg Intelligence’s senior ETF analyst Eric Balchunas shares some ideas of ways to emulate the experts’ themes.

Before you dive into the markets, it’s a good idea to make sure your financial basics are in order. That means having a sizable emergency savings fund, staying diversified across asset classes and making sure you aren’t paying more in fees than you need to. These are among the suggestions laid out in The 7 Habits of Highly Effective Investors.

2022 Q4

What’s particularly timely now is simply going back into the stock market. We’ve had a very tough year and history tells us that an opportunity could be here because we’ve been beaten down in so many categories.

We’re particularly interested in direct-indexing strategies for separately managed accounts. Direct indexing is like investing in an index fund, but the products use a tax-loss harvesting strategy that generates capital losses while replicating the overall performance of the market, and high-net-worth investors can always use capital losses. The market has been very volatile so it’s a great time for a product like this.

With the S&P 500, it’s 500 stocks but it’s the top holdings that generally move the index, and the product we use from Natixis has a strategy to own the top 150 stocks, including the largest stocks in each sector. They buy portions of those stocks and at the end of every quarter look at the portfolio and if there’s a short-term loss of 4% or more, or a long-term loss of 8% or more, they take the loss and buy something similar in the index.

For example, if Home Depot is down at the end of a quarter, they’ll sell it, take the loss and buy Lowe’s. They’re careful of the wash-sale rule, where you can’t buy a substantially identical position within 30 days and still take the tax loss. They’ve been particularly active in Apple this year — they’ve been in and out of the stock three times this year in our client accounts.

The cost for the strategy we use is about 55 basis points all in. Vanguard and Fidelity have products, and Eaton Vance has one too that uses about 250 stocks.

It’s one of the most unexciting asset classes historically, but we’re very excited about the income on high-quality bonds. You can get roughly 5% to 6% in investment-grade corporates, mortgage-backed securities and municipal bonds.

One of the most notable dynamics across the markets in 2022 has been this sort of breathless move higher in bond yields. It’s almost hard to believe the yield on the 10-year Treasury was 1.5% at the start of the year, and then went over 4% and has come down a bit. We all know why. It’s elevated, sticky inflation, commodity prices — basically all of the biggest bond enemies coming together to wreak havoc on bond investors.

Next year, inflation concerns will be replaced by growth concerns and we think the Fed will cut rates in the back half of the year to fight elevated unemployment. We’re looking at the income on bonds as incredibly competitive next to other options given this very challenging macroeconomic backdrop. It sets investors up for some really strong-looking forward returns.

As of the end of October, the aggregate bond index was yielding just over 5%, so the highest yields we’ve seen in 10 years, and investment grade corporate bonds are yielding nearly 6%. The decline we’ve seen in those bonds is greater than what we saw during the Great Financial Crisis and it sets up value.

We’re staying away from the highest-quality, shorter-duration bonds, because even if the yield is there now, the challenge is next year when we think the bond market reprices for recession. If you move out on the yield curve, you’re locking in attractive yields for a longer period of time. And we’re staying away from the lower rungs of the credit spectrum within high-yield bonds and finding opportunities in the middle of the risk spectrum.

In the near term, we think the private credit space and more specifically the direct lending space accomplishes a lot for investors. There’s a good element of safety in direct lending to mid-market companies with senior secured notes. But one of the main advantages is the ability to efficiently capture the front end of the yield curve in a rising rate environment.

For about the third time in 17 years, short-term bonds in the front end of the yield curve are getting you more yield than the long end. The annualized distribution rate for the fund we use [the sum of its distributions over the past 12 months divided by its current share price] was 8.85% recently. But also, if we do call an official recession and get more of a sideways economy, one of the more important parts of a portfolio will be income. There’s an opportunity here for a higher level of income without undue risk.

Prudence would also tell you that if we’re talking about fixed income we need to also think about adding duration to the portfolio — adding in more sensitivity to changes in interest rates. Because what if we are done [with rate increases], and there is a soft landing? We’re balancing our front-end exposure with more traditional bond exposure in the six-year duration range, which is in closer alignment with the aggregate bond index. It’s a cliche, but the best portfolio long-term is going to win for the investor with singles and doubles — you don’t need to take the risk to get the home run.

I think now is one of the best times to be investing in small caps globally.

If you go back 100 years, generally small caps outperform large caps over long periods by a premium of about 2%. And if you look over rolling 10-year periods, small outperforms large most of the time. But for the last 10 to 15 years, they’ve underperformed by a lot.

One reason for that is when you’re a little business you don’t really need to take on debt to grow, so you don’t benefit from low interest rates the way large companies do. We’re starting to see that unfair advantage narrow now.

As well, a lot of private equity firms have a lot of cash they need to invest, so it’s a wonderful time to have a small business that is growing revenue and doing something innovative, because they can be prime targets for PE firms to either take private or grow them and then spin them out publicly again some day. Also, large companies that struggle to innovate at their size may buy innovation versus trying to build it on their own.

A global small-cap ETF or index fund would be a low-cost, easy way for a retail investor to capture this theme. For an individual stock, one I like a lot and own is a Japanese company called Roland Corp. It makes electronic keyboards and amps, and it is the premier brand for electronic drum sets. The company’s market cap is under $1 billion and it has great gross margins. Like a lot of other companies, it’s down about 40% from its peak but they are still the best in the electronic drum business, and there is a very large market of musicians buying their stuff.

“Quality value” is where we see opportunity now.

What’s unique about today’s backdrop is that, because of all the gyrations around Covid with supply and demand, as well as the challenge of inflation, we see some wonderful companies selling at really great values. Usually high-quality business models come with a premium, and we are finding more opportunities of quality value.

You don’t often see growth and value names colliding. But growth has been disrupted by challenges such as inflation and gyrations in supply and demand, and these gyrations persisted much longer than many of us had hoped. It’s made companies that have inherent organic growth not look like growth companies. Yet if you look at the trajectory that companies were on from 2015 to 2019, it tells a very different story. If a company was gaining market share pre-Covid, and is navigating through Covid in a way that protects its business model and sets it up for a recovery, should we really be paying below-market multiples for it?

Take Ball Corp., which has the largest assortment of sizes and shapes in specialty beverage cans. They had to sell a profitable Russian plant at a low multiple and have had supply and demand challenges. This is a high-quality company that has always had nice returns, and management is moving to control what they can control — cutting costs, pulling back on capital expenditures, and protecting the business model that’s worked well for so long. It has traded well above its average PE over the past five years because of enthusiasm over its growth, and that premium has just been taken out in this moment.

We also like Hasbro. Its board game sales spiked during Covid and when the economy re-opened they had supply-chain challenges. Then those challenges eased and now retailers have too much inventory. Investors were concerned about leverage taken on in an acquisition but the company has de-levered nicely. They’re coming to the end of supply-demand issues and this is a wonderful free cash flow-generating business.

Hasbro lost its CEO in an untimely death in 2021, and the new CEO is not being given any credit on the Street for the growth strategy he’s laid out. It is aligning toy brands with content that pulls in demand, and a lot of it is movie content. For example, they sell Dungeons & Dragons and are selling more digital extensions into that; in March 2023 a big D&D movie is coming out. The stock is currently trading well below its 20-year average PE multiple.

2022 Q3

The markets right now are skewed to higher risk and lower return, so if I had $100,000 cash I would start conservatively and work to move money into the markets over the next three months. I’d look at ultra-short individual Treasuries, or an exchange-traded fund like the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) or the First Trust Enhanced Short Maturity (FTSM) as parking vehicles for cash.

After that, I’d start dollar-cost-averaging into quality US large-cap stocks. Timing the market is never smart — often we get it wrong — so being disciplined and deploying a set amount of, say, $2,000 a week into stocks is smart in this type of market. With downside risk on the horizon, cash and high-quality short bonds let you take advantage of pullbacks.

With the strong US dollar, I want to focus on domestic stocks, as a strong dollar makes for a difficult situation with emerging-market stocks. I don’t like developed international stocks since I feel Europe and Japan are both in a weaker economic position than the US.

I’d focus on quality value — stocks that weather slowdowns well. I’d put cash into the Health Care Select Sector SPDR Fund (XLV) and the Consumer Staples Select Sector SPDR Fund (XLP) to start with, and add in the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) if we see steadying demand in energy markets. I’d also consider the Invesco S&P High Dividend Low Volatility ETF (SPHD) or the First Trust Morningstar Dividend Leaders Index fund (FDL) for high-quality, low-volatility US large-cap exposure.

Defense is the name of the game for now as I see it — it’s too early for tech, small-cap and emerging markets, though as we fall further, it will become more attractive to rotate into those areas. Keep an eye out for opportunities, but remember that value traps abound right now. There may be a reason that stock fell 70%, and it could certainly continue to drop even further.

Historically, investors getting into private equity had barriers of entry, such as subscription documents, lockup periods, and maintaining the ability to meet capital calls. Using interval funds, which are logistically similar to open-end mutual funds, our clients don’t need to submit subscription documents, won’t have to meet capital calls, and every quarter we have an opportunity to recall our investment.

Ninety-five percent of companies in the US are private. We believe the funds we work with are on the cutting edge and are just at the beginning of what is to come. We work with bigger names, like Carlyle Group, but also with some smaller firms, such as Bow River Capital. Working with firms of different sizes lets us participate in deals ranging from large, oversubscribed ones to small diamonds in the rough. Some funds we use are more concentrated with 40 to 50 holdings and others, typically the private credit funds, have over 3,000 holdings.

We take a lesson we’ve learned from the public markets, which is the importance of diversification. In recent years tech has been, and continues to be, the hot space. While we love having exposure to the next Amazon or Tesla, we also value diversifying among the next big names outside of tech. Some of the private names include companies like Bass Pro Shops and Jaguar Land Rover.

Historically, private markets have shared a very low correlation to public equity markets. This allows us to smooth the ride for clients, especially in more volatile periods. With public equity markets being tougher this year, it has impacted valuations on the private space, affording an opportunity to invest in the names of tomorrow at yesterday’s prices.

The S&P 500 has been down 20% or more over a six-month period eight times since World War II. The first six months of this year were the latest example. Every time this has happened in the past, the market was positive for the next six months with an average return of 21.5%. Furthermore, in all seven previous times, the market has been positive for the following 12 months with an average return of 31.4%.

We follow a disciplined rebalancing strategy for our clients and have been adding to growth equity ETFs during this recent downturn. We rebalance accounts whenever the S&P 500 is up or down 5% from our last rebalance. We’ve added most to the broad US equity ETFs that are down the most this year, including Vanguard Growth (VUG), Vanguard Mid-Cap Growth (VOT), and Vanguard Small-Cap Growth (VBK).

We’ve successfully used this strategy during down markets and periods of increased volatility over the past 20 years. A market downturn can be a wonderful time to invest cash and we believe investing in simple, low-cost, diversified ETFs will give you the best results.

As well, we are always optimistic and believe that the world is going to continue to become a better place each year, so we especially like sectors that include innovation that will improve our futures. A few examples are the Blackrock Future US Themes ETF (BTHM), the iShares Virtual Work & Life Multisector ETF (IWFH), and the iShares Robotics & Artificial Intelligence Multisector ETF (IRBO). They’re down significantly from their highs and are a great opportunity for long-term optimistic investors.

The war in Ukraine will have a lasting effect as governments and companies become more focused on safety and security. When we think about security, we’re thinking beyond traditional military and defense spending — about food security, energy security and cybersecurity.

Russia and Ukraine are the breadbasket for Europe. The war has led to destruction of global trade, causing a spike in agricultural commodity prices. Historically, when there’s been disruption to food supply chains, particularly with grains, it has led to civil unrest, especially in lower-income countries. That further highlights the need to diversify supply sources and improve agricultural yields — through automation, better equipment, bio-nutrients or seed technology. Opportunities range from companies involved in crop science to those in machinery, food waste reduction and cold storage. Look for quality companies that are innovators, have solid management teams and have a good return on invested capital.

In energy, ending Europe’s dependency on Russian energy will require a lot of investment and time. It likely accelerates the longer-term trend to reduce the world’s dependency on fossil fuels. Companies in green tech, clean air and energy efficiency are among those positioned to benefit.

Near-term we expect increased spending in traditional fossil fuels to help alleviate supply-demand imbalances. Beneficiaries of that include some of the big oil-services companies and exporters of liquid natural gas that are executing well. You want companies that generate good free cash flow, as well as returning cash to shareholders. Given current commodity prices, free cash flow yield for energy companies is in the low teens — more than twice that of the S&P 500. Dividend yield for some energy companies is in the high single-digits versus the S&P 500’s 1.6%.

In cybersecurity, the need to protect data and systems continues to grow. With heightened geopolitical tensions, the greater the need for your data security to be like Fort Knox. The cybersecurity industry is quite fragmented, so selectivity is key. Look at the best-in-class companies, with a focus on robust software that is agile and adapts quickly.

My main message is to be picking around the secular growth part of the market, and get ready for the recovery. If you compare valuations in defensive sectors — health care, consumer staples, utilities — against growth stocks, they’re at peak valuations. You tend to see that at market bottoms. If we haven’t seen the bottom, we’re close.

Now the question is: Do you have enough exposure to sectors that do well when recession fears are fading? That’s a one- or three-year call. What tends to work well coming off bottoms is financials, mega-cap tech and small-caps.

Financials tend to underperform in drawdowns in recessions, but midway through tend to pivot and do very well coming off the bottom. As earnings season started, financials were one of the cheaper sectors compared to the S&P 500. When I talk to bank analysts, they say if we can avoid the more dire economic scenarios, banks are in a very strong position.

In tech, I’m talking about boring mega-caps — profitable semiconductor, software, hardware and equipment companies. With inflation high, the macroeconomic outlook choppy and labor tight, technology tools are what companies used to improve productivity and get through crises in recent years, so there should be some resilience in these business models. Tech also tends to underperform in drawdowns associated with recessions, and then pivot coming off of the bottom mid-recession. Valuations aren’t as compelling as in financials, but you’ve pulled the pandemic froth out and have reasonable valuations in a sector where you don’t usually see them.

With small-caps, recessions typically provide buying opportunities. The sector peaks ahead of recessions, underperforms in recessions and in mid-recession starts to outperform large-caps. Small-caps peaked relative to large-caps in March 2021. Now, small-caps look like they’re baking in a recession. The weighted median price-earnings ratio of profitable companies in the Russell 2000 typically bottoms out around 11 to 13. It was about 11.3 at the mid-June low in the market. Most sectors look reasonable or very cheap if you look at PE ratios relative to history, with more compelling valuations in financial and consumer discretionary.

There’s a lot of buzz around things like autonomous vehicles, electric vehicles and artificial intelligence in the emerging tech sector, but an area that’s really interesting and a little overlooked because there is controversy around it, and there should be, is what’s going on in the field of genomics.

There are exchange-traded funds dedicated to genomics research — the Ark Genomic Revolution ETF (ARKG) is one — and what comes out of these companies could be as revolutionary to our world, if not more, than electric vehicles and AI. So it’s worth adding it to the list of emerging tech to keep an eye on. It’s important for an investor to consider whether they have ethical aversions to some of the things that are in that space, like gene editing.

I’d advise a funds-based approach rather than try to pick an individual company because it spreads the risk around. Frankly, that’s important in any disruptive sector like this — it’s too much burden for an individual to do due diligence on one company and make a truly informed decision. So seek out either active ETFs, or mutual funds, or separate managed accounts with managers who have a proven track record in emerging tech.

Also important in this sector because it’s so controversial is to look at what areas of genomics a fund is invested in. If you have an aversion to gene editing, you’d want to avoid a fund that will give you exposure to that, and find one that focuses more on gene therapy or just DNA sequencing. ARK does invest in gene editing, so you can avoid that, or at least know what you’re owning. The flip side is that being an absolutist in any way for the most part is bad, so pay attention to the concentration. If only 2% of the fund is exposed to gene editing, that’s not very meaningful.

With any kind of alternative asset, generally speaking I say put no more than 5% to 10% of a portfolio in that, and really no more than 2% to 5% in something as specific as this.

2022 Q1

This is not an easy environment to invest in, because we’ve had all of this artificial asset inflation. In the public markets there are only a few things that are really attractive. There is developed-market equities outside of the U.S. — particularly in Europe and to a lesser degree Japan — as well as variable rate senior bank loans, which aren’t very sexy but could be interesting now.

In Europe, you see an economy that did not benefit from the massive fiscal stimulus we had in the U.S. They still have to catch up from Covid in terms of economic activity. But their inflation problem is much less severe than ours, and that’s really important. Also, there are more economically sensitive stocks in Europe, more value stocks, because they don’t have the big tech stocks that dominate the U.S. index. That’s another reason why they should be poised for a cyclical economic recovery. They also pay better dividends — around 2.5% to 3%, where in the U.S. it’s only 1.5%.

My other idea is bank loans. Banks make variable-rate loans, then sell them off and they end up in mutual funds. On higher-quality bank loans, you get a yield in the 3.5% range, and as rates go up, these rates go up with them. We don’t expect the credit environment to deteriorate, and we’re not seeing a recession. This is typically for clients who aren’t at the highest tax rate, because interest on bank loans is taxable at ordinary rates. These loans are another nice opportunity in an area where we’re trying to be somewhat defensive because of this big headwind we have in terms of the Federal Reserve reversing its posture from being so accommodative.

We like to be in sectors that benefit from rising rates and can push through costs to consumers in the current environment. One of those sectors is energy. We don’t believe that the big push to sustainable, carbon-free power through renewable energy sources, while admirable, is ready for prime time. The infrastructure required to capture, store and transmit clean energy is significantly behind the dream of a fossil-free energy world, especially in emerging markets.

We believe the transition to a carbon-free environment will take longer than anticipated. Coupled with falling reserves, lack of investment in discoveries and increasing demand, we think upward pressure on oil prices will continue for some time. The surviving companies of the last oil rout, with current oil prices, are generating significant free cash flows to pass along to investors, increasing dividends. With rising oil prices, oil companies have strengthened their balance sheets, and many enjoy 5% and higher yields. Some of the attractive mid-stream oil companies specializing in the transportation and storage of oil products have yields approaching 7% to 8%.

Another area we suggest for consistent and stable income — and that could be considered as a bond replacement — is real estate investment trusts. We like multi-family housing, health care and industrial REITs. With more office staff expected to work remotely, we stay away from office REITS and student housing REITs.

Here’s a strict income play, which won’t provide more upside than the coupon: Customized income notes. They can make a lot of sense for people who otherwise would look at traditional fixed-income products, and think that a high yield equals a good bond. I don’t think they realize they are taking on more risk than they should. Similarly, some people think stocks with high dividend yields must be good, but sometimes that just means a company’s share price has been beat up.

Customized income notes have been around a long time, and are more common in Europe. They can be tied to different indices, equity or bond. The indices don’t have to go up, but the coupon rate could be 6% to 9%. You can create a note that says as long as the S&P 500 is not down more than 30% over the next 30 months you’ll get monthly or quarterly coupon payments with a 7.75% annual yield. In some cases, if the note dips below the threshold level you may miss that particular payment. As the underlying index improves above that level, the note resumes payment.

With inflation where it is, I like equity markets more than bond markets — and more than cash for sure. The notes are only as good as the issuers, who are large, well-known institutions. To price and fill these notes, we use technology from a group called Halo. You can lay out parameters customized for your client and get real-time bids from all of the major banks.

I also like private placements. You can help entrepreneurs, and it helps you get uncorrelated returns to traditional stocks and bonds. There’s a big push for energy efficiency within the commercial multifamily housing sector, and I see opportunities there.

With relatively high equity valuations and the potential for rising interest rates (combined with low current yields) rendering public equities and fixed income relatively unattractive, we have been recommending that our clients put cash to work in private REITs.

Generally, REITs offer investors a higher yield than fixed income with lower interest-rate risk. Investors may also benefit from appreciation in the underlying value of the properties owned by the REIT. Additionally, real estate offers a degree of inflation protection as rents tend to rise concurrently with prices.

We have targeted REITs that focus on multifamily and industrial (e.g., logistics) real estate in fast-growing markets with economic tailwinds such as Raleigh-Durham in North Carolina (our home), Nashville, Denver and Austin. We favor private REITs relative to public REITs, because private REITs are less correlated with the broader public-equity markets and, as a result, are generally less volatile.

We’re having a lot of conversations about crypto. If you have the proper risk tolerance, there can be a lot of benefits to allocating 1% to 5% of your investable net worth in crypto. Cryptocurrency has a reasonably asymmetric risk profile: you put 2% in bitcoin, the most you can lose is 2%, but in 2021 bitcoin was up around 57%, so you’re adding almost 1.5% return to your overall portfolio from that small portion. Of course, there will always be volatility in that space until it’s more seasoned, but if you’re investing in a taxable account, there are potential tax-loss harvesting opportunities as well.

We use a separate account manager, Eaglebrook Advisors, which can do systematic tax-loss harvesting — automatically booking losses to offset capital gains elsewhere in portfolios. If a token price drops 10% below a client’s cost basis, the SMA will sell it and immediately repurchase it without running into the wash-sale rule. [The wash-sale rule says investors can’t take a loss on the sale of a security in their taxes if, within 30 days, they buy a “substantially identical” security.] It can do that because under current IRS rules, cryptocurrency is classified as a collectible and not a security. This classification is currently under review and could go away in the future.

For clients looking for income, we’ve leaned more on dividend-focused equity ETFs, as well as some areas of private credit and mutual funds where you can get alternative income exposure. Funds we’ve used include BlackRock’s tactical opportunity and systematic multi-strategy funds. The multi-strategy fund’s core is a long-only, multi-sector fixed income exposure, and it aims to provide credit exposure with less downside risk than traditional high yield. The tactical opportunity fund looks to provide uncorrelated returns to traditional equity and fixed income markets. As of Feb. 11, the tactical fund was down 0.21% and the multi-strategy fund was down -2.1%.

Our goal as advisers is to protect as much on the downside without sacrificing too much return on the upside. These products provide buffers for when markets get volatile, as we’ve seen recently. In good times, you may not keep up with the S&P 500, but if the market is down 10% and your portfolio is down 7%, you’ll be in a better position to rebound than if you’d ridden that full market wave.

2021 Q3

People who are diversified in stocks and bonds may have underrated the value of private commercial real estate. The headline news for commercial real estate is that no one is going back to the office. But the asset class is much more diverse than offices and offers other benefits.

Private real estate includes office space, apartments and industrial real estate. It’s a less volatile asset that moves differently than public real estate and stocks and bonds, to some degree. It also does quite well when stocks are falling and has a more attractive starting yield than bonds. The income component in the benchmark index for private real estate funds, the NCREIF Fund Index-Open-End Diversified Core Equity Index, has been about 4% in recent periods and nearly 7% since 1978. We think having some exposure to real estate all the time is good, and our clients typically have 10-15% in it.

The question you want to ask is: Are there times when you personally want to be long less-liquid assets — are you being paid to take on the less liquid nature of an investment? With private real estate I think you are. That said, of course all investments have the risk of loss.

Some people will say that they already have real estate investments. But these folks are typically talking about investing in their own backyards. When you go into one of these funds, you get national exposure. We have our own real estate fund for accredited investors and though we’re based in the Bay area, we have a lot of exposure in the Heartland.

Knowing the mix of real estate food groups in a fund is important. As an example of how these funds invest, Bailard’s fund is over 40% invested in multifamily properties, with about 20% each in office space and industrial property types and the remainder in retail, data center and development projects. By geography, the largest slices of the pie are in the Southeast, Pacific and the West North Central region, which includes cities like Minneapolis and St. Louis.

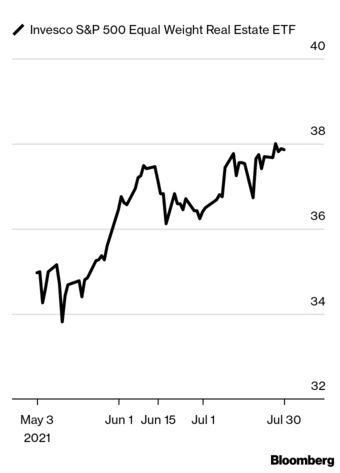

could make sense. It assigns each real estate stock an equal weighting, which means it has more of a tilt to the smaller, less liquid names. EWRE has easily outperformed most market-cap weighted REIT benchmarks and comes with a fee of 0.40%.

could make sense. It assigns each real estate stock an equal weighting, which means it has more of a tilt to the smaller, less liquid names. EWRE has easily outperformed most market-cap weighted REIT benchmarks and comes with a fee of 0.40%.

We’re putting client money in the Millennium USA HedgeFocus Fund, a multi-strategy fund of funds. Millennium Management has a very, very long and solid track record. Their annualized return since 1990 is 14% and the worst 12-month rolling net return was in 2008 and was -3.5%. You don’t see that very often, and this fund doesn’t open up very often. But it’s open right now.

Millennium has a very disciplined process of finding new talent and firing bad talent. It’s a constant process. It gets good talent and if they are good, they stay. If they lose ground to their peer group, they’re gone.

Millennium describes the fund as having “a market neutral, multi-disciplinary approach,” with strategies that include relative value fundamental equity, event-driven, statistical arbitrage, and quantitative strategies, fixed income and commodities. The largest percentage is in fixed-income now, at 31%.

The fund doesn’t move with the broad stock market. In March 2020, when the pandemic hit the globe, the fund was down 95 basis points. That was its only negative month in 2020. That’s what this fund is for — it’s your weathering-the-storm injection into your portfolio. It’s not going to be the home-run hitter when tech stocks are going through the roof, but you are not going to be sorry you owned this thing when the market takes a hit. We wouldn’t want to have this go above 10% of a client’s portfolio; typically it’s between 2-5%.

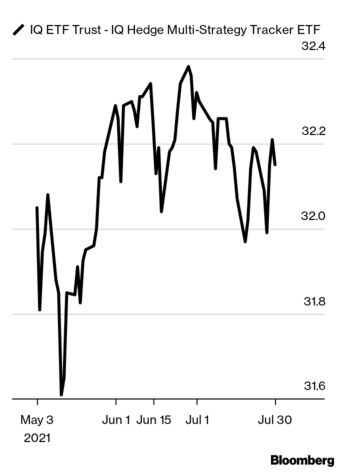

, said Balchunas of Bloomberg Intelligence. It uses other ETFs to replicate the returns of a multi-strategy hedge fund of funds, with strategies including global macro, long-short, fixed income and event-driven. The ETF is only partially hedged however, so may move a little more like the market than a typical hedge fund. The fee is 0.78%.

, said Balchunas of Bloomberg Intelligence. It uses other ETFs to replicate the returns of a multi-strategy hedge fund of funds, with strategies including global macro, long-short, fixed income and event-driven. The ETF is only partially hedged however, so may move a little more like the market than a typical hedge fund. The fee is 0.78%.

We have a large-cap portfolio of around 100 individual stocks that rank well among environmental, social and governance (ESG) criteria relative to their peers. Climate change and movements for social justice, along with the proliferation of available ESG metrics, are raising the profile of companies that are good corporate citizens.

I like the intersection of cyclical stocks with strong ESG scores given the economic strength and robust corporate earnings expectations coming out of the pandemic. Bearing in mind uncertainty and changing expectations given delta variant news, Linde Plc (LIN) checks all of the boxes as a cyclical stock in the materials sector. Linde is a leader in industrial gases and in developing green hydrogen, which can produce energy with zero carbon emissions. This segment of the alternative renewable energy sector is poised to boom with President Joe Biden’s goal of decarbonizing the electric grid by 2035.

Toyota Motor, Honda Motor and Hyundai Motor have already begun developing hydrogen fuel cell electric vehicles. The Toyota Mirai, currently available in California, can be charged in five minutes at a hydrogen pump with a range of 402 miles between refueling.

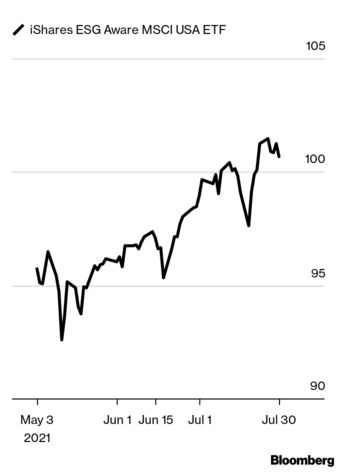

For those who can’t build a custom ESG portfolio, the iShares ESG Aware MSCI USA ETF (ESGU) is the largest socially responsible ETF. The iShares U.S. Basic Materials ETF (IYM) provides more direct exposure to basic materials but lacks the focus on ESG issues.

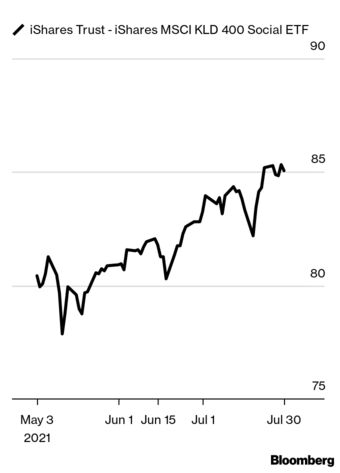

is the biggest ESG ETF, be warned that it looks a lot like the S&P 500 Index and owns stocks such as Exxon Mobil, which some ESG investors may be surprised to see. It has a fee of 0.15%. For those looking for slightly more pure ESG exposure, the iShares MSCI KLD 400 Social ETF (DSI)

is the biggest ESG ETF, be warned that it looks a lot like the S&P 500 Index and owns stocks such as Exxon Mobil, which some ESG investors may be surprised to see. It has a fee of 0.15%. For those looking for slightly more pure ESG exposure, the iShares MSCI KLD 400 Social ETF (DSI) will eliminate many of those types of names without beefing up too much concentration in any one sector. DSI has a fee of 0.25%, Balchunas said.

will eliminate many of those types of names without beefing up too much concentration in any one sector. DSI has a fee of 0.25%, Balchunas said.

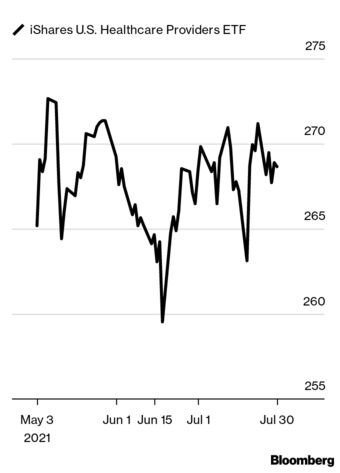

One area we’ve spent a lot of time thinking about, largely because of the pandemic, is the healthcare space. We’ve seen engagement by consumers for information and access to vaccines. We’ve also seen a mobilization of healthcare services take place in a very local and convenient way.

We want to lean into healthcare services companies that are really focused on this point of convenience. That got us thinking about healthcare service insurance companies. One company we like is in the growth bucket, and the other is in value bucket.

The growth company is UnitedHealth Group. For a long time it’s demonstrated really strong execution and returns in its own business and in returns to shareholders. Part of the reason it’s been such a high-quality company is that almost 50% of its business is tied to healthcare information technology — they have data that comes from their Optum business, which consults with corporate clients on health-care costs. The other 50% of the firm’s business is healthcare insurance.

Technology and data are tools to help bring costs down, and UnitedHealth can make really well-informed decisions on their healthcare services products. Their price-earnings multiple is at the higher end of their valuation range, so the returns from here are more in the mid-teens, but it’s just a safe bet in many ways and they are leaning into telehealth.

A stock that’s more on value side with a lot more upside if it executes is CVS, which merged with Aetna almost three years ago. The two companies have a lot of digital knowhow, and they, too, are leaning into telehealth and finding how well it delivers for certain areas of care, specifically mental health care but also dermatology and other areas.

CVS is reentering the Affordable Care Act arena with a product at a low price point for the individual market, which is the hardest area to serve profitably. If it works, it’s an exciting testament to the idea of pulling digital capabilities, healthcare knowledge and reach into a consumer-convenience package. We like to look at average 10-year price-earnings multiples and the company is trading well below its 10-year multiple.

, which tracks companies engaged in health care, facilities and insurance. The ETF has 22% of its portfolio in UnitedHealth. The fee is 0.43%.

, which tracks companies engaged in health care, facilities and insurance. The ETF has 22% of its portfolio in UnitedHealth. The fee is 0.43%.

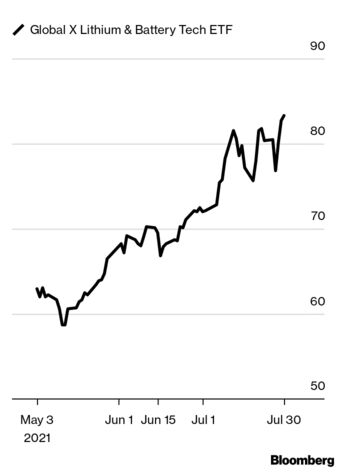

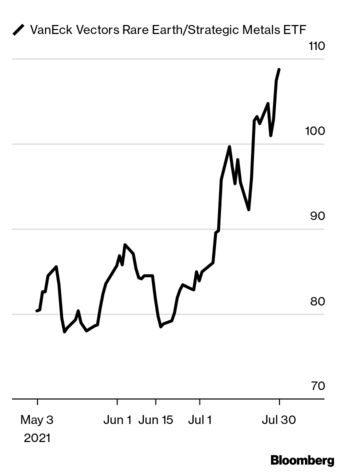

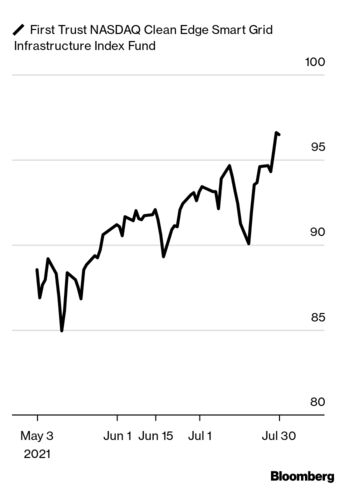

Climate change is slapping us in the face, and almost every element of the U.S. economy will need to be revamped. A starting point is the electrical grid. The solution seems to be solar power and wind power combined with batteries and a restructuring of the grid so we can pull power from where we have sun and wind to places we don’t.

I’ve thought about putting money into hedge funds that focus in this area. But they have to short something to dampen the volatility of their returns. When you’re trying to invest in this huge transition, you should just be long and suffer through the volatility, and not give up 35-40% or more of the overall return you could get by being long equities yourself.

Publicly traded clean energy stocks are expensive and in many cases quite frothy. But when you find a huge macro tailwind on an asset class like this it just tends to work and you make money. An area that’s a little less appreciated is the sector that will rebuild the grid in the U.S. This will create many opportunities and these companies aren’t as well known. They include MYR Group (MYRG), MasTec (MTZ), and Quanta Services (PWR).

When it comes to solar and batteries, the challenge is that most of these names are Chinese and aren’t easily traded through U.S. brokerage accounts. Therefore, my suggestion is the Global X Lithium & Battery Tech ETF (LIT) and VanEck Vectors Rare Earth/Strategic Metals ETF (REMX). I’m not an advocate of owning Chinese equities in general but because they are so far ahead in solar and battery manufacturing relative to anything you can access in the U.S., they’re a must-have.

and 0.60% (REMX)

and 0.60% (REMX) , respectively, Bloomberg Intelligence’s Balchunas points to the First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index (GRID)

, respectively, Bloomberg Intelligence’s Balchunas points to the First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index (GRID) , which is basically a theme ETF dedicated to making the grid smart and clean. It holds three of the stocks mentioned above and comes with a fee of 0.70%.

, which is basically a theme ETF dedicated to making the grid smart and clean. It holds three of the stocks mentioned above and comes with a fee of 0.70%.

Although most of our clients’ capital is invested in public markets using low-cost mutual funds and exchange-traded funds, we see the private market, or non-publicly traded investments, as a compelling way to diversify. The number of U.S.-listed public companies has been cut in half over the last two decades, with over 95% of U.S. companies now controlled through private capital. More growth and value creation of a company is being captured by private investors, and those companies are staying private longer compared to early-stage initial public offerings.

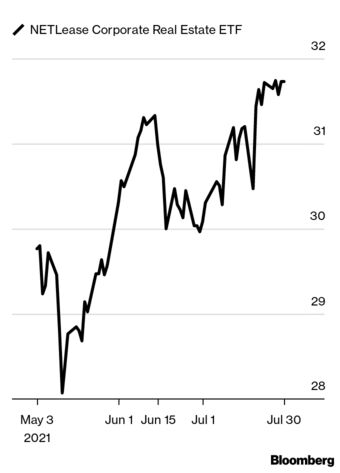

We believe there are attractive opportunities in the triple-net-lease and private equity direct-lending space to help enhance the income component of a portfolio. (Triple net leases require a commercial tenant to pay rent, property tax, insurance premiums and maintenance on a property, usually in exchange for a lower rent.) However, diversification plays an important role in both public and private investments. Therefore, we prefer private equity funds with a basket of holdings versus a direct investment into a single company within the target sector.

We look for funds with seasoned management teams. It’s the skill of those key players that can have some of the greatest long-term impact on the underlying companies and ultimately the fund. Understanding a given fund’s redemption terms is also key to ensuring the opportunity is right for you. Investors can get hung up on liquidity risk, but when allocated appropriately in a portfolio the outcome can often be worth the wait.

, said Balchunas. It tracks companies that derive at least 85% of revenues from real estate operations in the net lease real estate sector. NETL’s fee is 0.60%.

, said Balchunas. It tracks companies that derive at least 85% of revenues from real estate operations in the net lease real estate sector. NETL’s fee is 0.60%.

2021 Q1

We like multifamily real estate, and work with a partner that focuses on acquisition and development of multifamily properties. We structure the deals as limited liability corporations and our investors get direct exposure to a pool of six to seven properties. You get the beauty of direct exposure but don’t have to go through the underwriting of every deal every time.

There is still such undersupply in affordable housing for the so-called “missing middle.” This is firefighters, nurses and so on that have fixed salaries and have about 30% of their income going toward their housing budget and rental. The supply for these workers just doesn’t exist in many urban/suburban communities. Think primary, secondary and sometimes tertiary real estate markets where you won’t have a boom-bust cycle, so places like Montgomery, Alabama and Denver, Colorado that are growing fast and need the support of housing.

In part, we’re interested because of cash flow — we want cash flow coming from a majority of the properties, although when there is development involved there is obviously a lag. Unlike with traditional real estate funds, our investors get the benefit of depreciation. There’s also the opportunity for a future 1031 exchange if clients wish. [Investors that sell an investment property can avoid capital gains taxes if they reinvest the money in a similarly valued property or properties within a short period of time.]

is composed of 100 companies that represent the performance of the U.S. residential housing industry, and includes some multi-family REITs, said Balchunas. It also holds homebuilders and retail stocks, however, so it isn’t just a REIT ETF. HOMZ, with $59 million in assets, has an expense ratio of 0.45%.

is composed of 100 companies that represent the performance of the U.S. residential housing industry, and includes some multi-family REITs, said Balchunas. It also holds homebuilders and retail stocks, however, so it isn’t just a REIT ETF. HOMZ, with $59 million in assets, has an expense ratio of 0.45%.

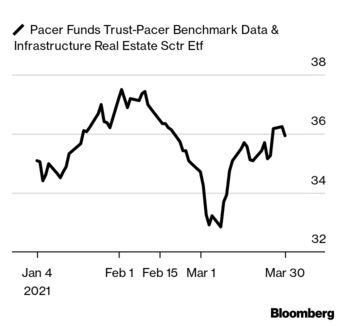

Investing around the need for technology infrastructure became trendy in mid- to late 2020 and then faded away. It’s still as good an investment idea as it was. We need bigger server farms, and cybersecurity for those farms, and people want internet wherever they go. Even if prices don’t look like you’re buying at a discount, the total addressable market continues to get bigger and bigger.

As a play on that, we built a sort of real estate piece for client portfolios that’s about 6% of assets. Our real estate exposure is not commercial real estate, not office buildings, nothing like that — it’s the real estate of the Internet. It’s all 5G and data center-related names, and we mix and match ETFs and individual stocks. Part of the reason we built this slice is that it produces income. A lot of real estate investment trusts (REITs) produce income, but those of us with a real estate background know that’s only good until they can’t collect the rents.

For a passive investor, the Global X Data Center REITs & Digital Infrastructure (VPN) ETF has all the names in it, and if you want a pure data play, there’s Digital Realty Trust, Inc. (DLR). But if you have $100,000 to invest you can build nice positions in some big, liquid stocks. Our real estate piece consists of DLR, Lumen Technologies, Inc. (LUMN), CoreSite Realty Corp. (COR) and Crown Castle International Corp. (CCI).

, which also tracks data center and cell tower REITs, said Balchunas. It has $1 billion in assets and charges 0.60% versus the $25 million in assets and 0.50% fee for VPN.

, which also tracks data center and cell tower REITs, said Balchunas. It has $1 billion in assets and charges 0.60% versus the $25 million in assets and 0.50% fee for VPN.

We have an all-weather portfolio of 40 stocks designed to capture the value side of equity markets, with a focus on dividend growth. Within that portfolio, we like energy stocks quite a bit. Energy represents about 12% of the portfolio and oil stands out as a good value, along with the financial sector, particularly in an environment of rising interest rates and inflation.

There’s a play on stable to rising oil prices as it relates to a better economy. All this enthusiasm we see for the Teslas of the world, and with GM’s electric vehicle announcement—there will be a transition and the traditional fossil fuel companies will adjust, particularly if they have strong balance sheets. But things always move more slowly than we think, especially outside the U.S., in places like emerging markets.

I like the traditional oil sector and four companies, in no particular order — Exxon Mobil (XOM), which pays a dividend of more than 6% and has committed to stabilizing that dividend, Chevron (CVX), which has a great balance sheet and yields around 5%, Kinder Morgan (KMI), a natural gas play that yields about 6.3% and Enterprise Products Partners (EPD), which yields 8%.

It takes time to convert to electric vehicles and these stocks are somewhat undervalued for that reason. The opportunity here is cash flow. This is is a great way to own growth plus income, and a very good inflation hedge. For those who can’t adequately diversify with individual securities, there is a terrific ETF, Energy Select Sector SPDR Fund (XLE). It yields about 5% and you’re basically owning the whole sector.

is a fine play if the goal is to get heavy exposure to Exxon Mobil, Chevron and Kinder Morgan, all of which together make up about 48% of XLE’s entire portfolio weight, said Balchunas. Exxon Mobil and Chevron each have about a 22% weight in the ETF.

is a fine play if the goal is to get heavy exposure to Exxon Mobil, Chevron and Kinder Morgan, all of which together make up about 48% of XLE’s entire portfolio weight, said Balchunas. Exxon Mobil and Chevron each have about a 22% weight in the ETF.

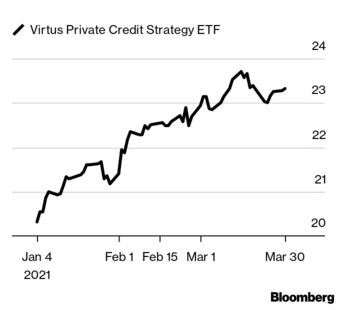

Our primary focus is on alternative sources of income generation. An interesting area we’re looking at is private credit, in particular a fund offered by BlackRock. The funds get superior yields to the two-year Treasury and with a level of credit risk that we don’t see as a major issue in this economic recovery. You get income on a monthly basis and it has good liquidity so to an investor it can feel bond-like. Our expectation is that cash income will be between 7% and 8%.

We think BlackRock has great insight into the creditworthiness of companies they put into their debt product. There’s underwriting risk — you have to ask is BlackRock good at underwriting the risk of that particular credit, have they done a good job of analyzing the company’s ability to service debt. Then there are the general macroeconomic issues. That was why we were particularly interested in this fund during an economic recovery, because we don’t think that the credit risk is unduly high.

We also have an idea that’s a little contrarian. Our thesis is that if you are with the right commercial real estate providers there will be a good opportunity for current income and capital appreciation. Office buildings in areas people are moving out of isn’t a great idea, but industrial logistics warehouses in areas where people are moving is interesting.

We use two private REITs, the Hines Global Income Trust and the Blackstone Real Estate Income Trust. The funds have a cash yield of about 6%, most of which is tax-deferred. Both funds have the wherewithal to build big portfolios in areas where the risk is not as high, and they’ll only invest in areas where population growth exceeds the national average.

indirectly tracks private credit via business development companies (BDCs) and closed-end funds. The ETF, with just $24 million in assets, yields 8.8%, but has to pay the fees of those underlying BDCs and funds, which brings its expense ratio to about 7.6%.

indirectly tracks private credit via business development companies (BDCs) and closed-end funds. The ETF, with just $24 million in assets, yields 8.8%, but has to pay the fees of those underlying BDCs and funds, which brings its expense ratio to about 7.6%.

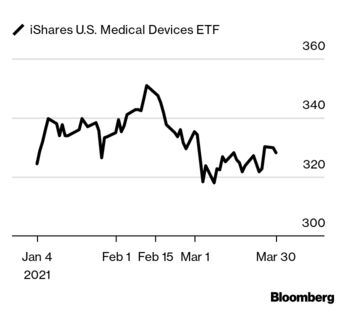

A theme we think is compelling is the continued convergence of technology into healthcare. There has been a massive convergence of the two, as so much innovation has been spawned in the Covid era. You have this incredible horsepower of what tech can provide in health-care analysis, in vaccines and other things. It’s an accelerant to medical discovery, with fascinating ramifications in immunotherapies, artificial intelligence, gene technology, robotics and much more.

Along the same lines in healthcare, you have this totally separate parallel yet very powerful trend in telemedicine. Virtual care seems to have achieved escape velocity from concept to a bona fide long-term delivery model.

The medical device space is where I feel the convergence is most promising. As an example, and not necessarily a recommendation, what a firm like Dexcom is doing for diabetes monitoring is just life-changing. It basically designs, develops and commercializes continuous glucose monitoring systems, and it’s all pretty much application-based. Dexcom has a remote monitoring system, though wireless connections, and patients have a receiver. It’s an app on the patient’s iPhone to see where they are at any given moment, but as important is that it’s for the person who’s looking out for someone with diabetes, and you’re talking about millions of people.

There are number of sector ETFs in the medical device area. The iShares U.S. Medical Devices ETF (IHI) is an established ETF I like, and there are a handful of more narrowly focused ETF strategies like the Global X Telemedicine & Digital Health ETF (EDOC) and ARK Genomic Revolution (ARKG).

is one of the most quietly popular ETFs out there, with $8.2 billion in assets while charging 0.43%. It is the best way to get just medical devices, Balchunas said. EDOC and ARKG have some medical device exposure but branch out into other industries as well, such as software and biotech.

is one of the most quietly popular ETFs out there, with $8.2 billion in assets while charging 0.43%. It is the best way to get just medical devices, Balchunas said. EDOC and ARKG have some medical device exposure but branch out into other industries as well, such as software and biotech.

2020 Q4

The world is in desperate need of infrastructure investments. In addition to traditional maintenance on roads and bridges, our modern economy requires building and maintaining next-generation transportation and logistics, energy, and communications systems. One manager we like, Stonepeak Infrastructure Partners, puts money into a diverse subset of infrastructure sectors including power and utilities, transport and logistics, water, midstream energy, and communications.

We’re the most enthusiastic about their investments in communications and cold storage. The communications category includes wireless towers, data centers, and satellite networks to serve rural geographies.

Rural consumers rely on non-traditional internet providers, such as satellite networks, in the absence of robust cable and fiber infrastructure. The cost and economics to “wire” these individuals through traditional measures is prohibitive. The federal government, through the FCC’s Universal Service Fund (and other programs, such as the Connect America Fund) provide subsidies to satellite companies so these consumers have access to affordable internet, which helps to support demand.

Meanwhile, the cold storage industry, which maintains refrigerated warehouses and trucks, has showcased its resiliency during the recent economic downturn. We believe demand might accelerate as companies rethink their global supply chains and move more of the country’s mission-critical food and pharmaceutical supplies onshore.

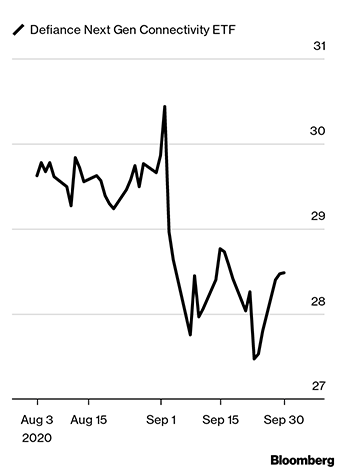

, which tracks an index of firms that make up the backbone of the country’s communication infrastructure that are investing aggressively to expand connectivity. These firms include device manufacturers, chipmakers and content-delivery networks. The fund also includes major tower REITs American Tower Corp. and Crown Castle International Corp. alongside core services for telecommunications companies. The expense ratio is 0.30%.

, which tracks an index of firms that make up the backbone of the country’s communication infrastructure that are investing aggressively to expand connectivity. These firms include device manufacturers, chipmakers and content-delivery networks. The fund also includes major tower REITs American Tower Corp. and Crown Castle International Corp. alongside core services for telecommunications companies. The expense ratio is 0.30%.

An alternative source of income we like is trade finance receivables. Say you have an exporter in India who wants to sell their goods to someone in the U.S. They agree on a price, but the exporter typically doesn’t want to ship goods until they are paid, and the U.S. firm doesn’t want to pay until they have the goods. There are intermediaries that step in to advance the majority of the payment to the exporter, and when the goods arrive they send the balance of the payment.

More and more fintech companies are doing this kind of finance. The one we use is called Drip Capital. You can get six-month and one-year notes backed by typically less than 90-day trade receivables across a wide range of commodities and exporters, and you can earn a 6% to 8% annualized return.

One risk is that something could happen to the commodity en route. They take out an insurance policy that covers 90% of the cost of the goods, and also take out insurance to mitigate the risk of credit losses. It’s a good source of income and it’s not necessarily correlated to the stock market or interest rates. There’s not a lot of places where you can get 7% uncorrelated for six months.

. The fund has a yield around 7% and a 0.78 correlation with price moves in U.S. equities. The expense ratio is 0.12%.

. The fund has a yield around 7% and a 0.78 correlation with price moves in U.S. equities. The expense ratio is 0.12%.

We’re allocating money to a private credit fund that’s looking to take advantage of opportunities in the private equity-backed company sector, for the lower middle-market segment — so companies with $25 million or less in earnings. There are nearly 200,000 companies in the U.S. middle market and over 500 middle-market PE firms.

These are high-quality businesses experiencing temporary financing needs. They’ve had interruptions in cash flows, and their debts have covenants and certain earnings targets they need to have in order to maintain their capital structure. Owl Rock Capital, which has a fund we’re using to invest in this area, estimates that 30% to 40% of these companies will need financing of some sort — restructuring, additional debt, an infusion of equity — because they’re close to tripping a debt covenant and need cash flow, or because they want to make an acquisition in their own space.

The fund we’re using can build creative structures and protections while generating good income and equity-like kickers. It lends money that is in most instances senior secured, on the top of the capital structure, so there is substantial risk mitigation. Also, the fund is uncorrelated to traditional fixed-income and equity markets. It aims for a conservative 10% to 13% net return, with current income accounting for much of the return.

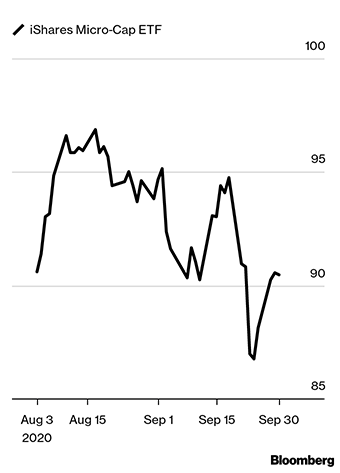

tracks an index of companies that don’t have as much access to bridge or intermediate-term financing during the pandemic as larger firms. Balchunas and Barna note that while the equity upside is intact, diversification across 1,260 holdings is the only protection against risk. The fund’s holdings have an average market capitalization of $680 million. The expense ratio is 0.60%.

tracks an index of companies that don’t have as much access to bridge or intermediate-term financing during the pandemic as larger firms. Balchunas and Barna note that while the equity upside is intact, diversification across 1,260 holdings is the only protection against risk. The fund’s holdings have an average market capitalization of $680 million. The expense ratio is 0.60%.

You say commercial real estate now and everyone has a negative reaction, and we have a sort of counterintuitive idea there. It’s real estate companies that build data centers for big cloud computing companies such as Amazon.com, Alphabet, Microsoft, or that build for big biotech companies like Bristol-Myers Squibb, Sanofi-Aventis, and so on.

In the biotech area, there’s a real estate investment trust, Alexandria Real Estate Equities, which is the leading owner and operator of science real estate. It builds buildings with science labs in them already, and we know how prominent biotech and biomedical research is now. They build in metro areas, close to universities. Everyone is talking about how people are moving out of the cities, but when this calms down and you’re a recent graduate of MIT or Stanford, you will want to live where other young people are, where there is a social scene.

In the cloud computing area, we like Equinix (EQIX), which builds data centers worldwide to keep up with the growth of cloud computing. We consider it a company with a lot of growth potential, even though the stock has moved up a lot this year, and it pays you a dividend of 1.4%. Another company we like is Digital Realty Trust (DLR), which owns 275 data centers around the world and has a dividend of about 3%.

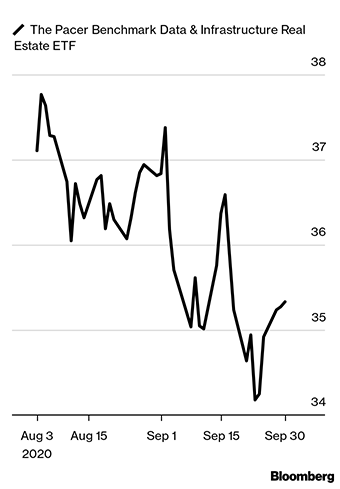

holds core companies developing and managing U.S. wireless communications infrastructure and server-warehousing REITs, including Equinix as its second largest position. The fund has a concentrated portfolio of 22 securities, over $1.1 billion in assets and charges 0.60%.

holds core companies developing and managing U.S. wireless communications infrastructure and server-warehousing REITs, including Equinix as its second largest position. The fund has a concentrated portfolio of 22 securities, over $1.1 billion in assets and charges 0.60%.

There is a real need for a fixed-income alternative because interest rates are so low — people are starved for income. We have been creating structured income notes for our clients. It’s a way you can build something that will generate income that actually has downside protection, and you can achieve higher yields at a time when the 10-year Treasury is just around 0.89%.

Depending on how much downside protection you want to build in and the maturity, the yield can be from 2% to 8%. We recently created an S&P 500 note with 40% downside protection for a two-year term. That yielded roughly 5% in annual income. The index doesn’t have to go up, you just don’t want it to go down more than 40% at maturity. We design the note and bid it out to other banks and issuers.

You need at least $100,000 to put into these notes, because we tend to not put more than 20% of structured notes in any one portfolio. So you’d have to have at least a million, because we want to make sure people are diversified.

, which offers investors exposure to large-cap U.S. equity beta with put-spread options for incremental income and some protection against initial market decline. The fund has a net indicated yield near 3.5%, a 0.76% expense ratio and no investment minimum.

, which offers investors exposure to large-cap U.S. equity beta with put-spread options for incremental income and some protection against initial market decline. The fund has a net indicated yield near 3.5%, a 0.76% expense ratio and no investment minimum.