ESG Assets Rising to $50 Trillion Will Reshape $140.5 Trillion of Global AUM by 2025, Finds Bloomberg Intelligence

July 21, 2021

BI expects ESG ETFs to reach $1 trillion and ESG Debt $11 trillion by 2025

London and New York, July 20, 2021 – Environmental, Social and Governance (ESG) assets are on track to exceed $50 trillion by 2025, representing more than a third of the projected $140.5 trillion in total global assets under management, according to Bloomberg Intelligence’s (BI) latest ESG 2021 Midyear Outlook report.

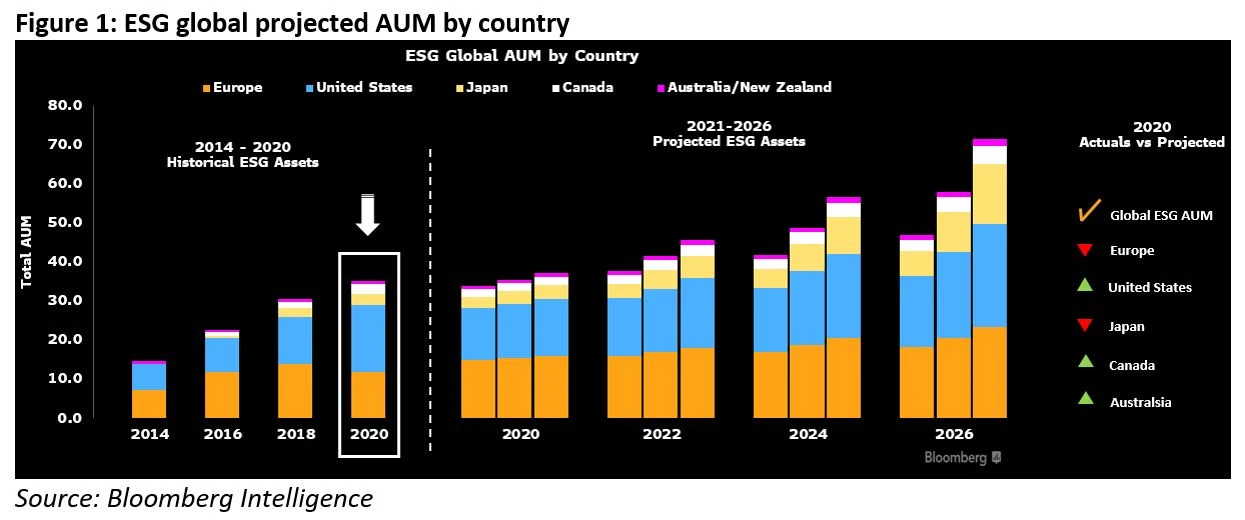

ESG assets surpassed $35 trillion in 2020 up from $30.6 trillion in 2018 and $22.8 trillion in 2016 reaching a third of current total global assets under management, according to the Global Sustainable Investment Association. ESG assets crossing the $35 trillion mark is in-line with BI’s own base-case scenario. Assuming 15% growth, half of the pace of the past five years, ESG assets could exceed $50 trillion by 2025. BI adds that the world is on track to have a $1 trillion ESG ETF market and an $11 trillion ESG debt market by 2025. Both ESG ETF and ESG debt are leading the growth among ESG investing strategies.

Adeline Diab, Head of ESG and Thematic Investing EMEA & APAC at Bloomberg Intelligence, said: “The pandemic and the global race to net zero carbon emissions have put ESG criteria into orbit – from niche to mainstream to mandatory. ESG is fundamentally reshaping the financial industry, becoming part of financial reporting. This is in part due to mounting scrutiny from regulators, markets being more sensitive to ESG-related news, and asset owners appointing managers on the basis of ESG across asset classes.

“While Europe has historically led on ESG assets, the U.S. has seen over 40% growth over the past two years and now accounts for $17 trillion, so nearly half of the global $35 trillion ESG assets under management. Europe’s ESG product landscape may serve as a barometer for what to expect globally. The region’s ESG mutual funds and ETFs accounted for circa 25% of all European products in 2020. Particularly, products are increasingly being rebranded as ESG, as investors seek to attract assets. However, this trend may be a double edged sword as regulators scrutinize these products more closely.”

According to BI’s report, ESG ETFs’ inflows are on track to surpass the projected $115 billion in 2021 given over 65% of the inflows have already been recorded in the first half of the year. February 2021 saw the highest monthly inflows recorded with $20.5 billion, beating the previous record of November 2020 at $13 billion. The trend is in line with BI’s bull case scenario which assumes 35% per annum growth and, as such, BI expects $1 trillion in ESG ETFs by 2025.

Diab added: “ESG ETF cumulative assets reached around $225 billion in 2020 accounting for almost 15% of global ETF asset growth that year. Though Europe has dominated ESG ETFs, U.S. products have supported the next wave of organic expansion.”

BI’s latest ESG 2021 Midyear Outlook also noted that the $3 trillion ESG debt market could grow rapidly to $11 trillion by 2025, assuming it expands at half the pace of the past five years. Growth is unlikely to slow, driven by companies, development projects and central banks focused on the pandemic and green-recovery efforts, the push to net zero and record low interest rates.

For instance, the European Union’s pledge of EUR100 billion to support employment, the EU’s EUR225 billion to fund a post-pandemic recovery, U.S. President Joe Biden’s $1.2 trillion infrastructure strategy, and the challenge of China’s 2023 green-debt maturities all signal ample room for new issuance.

Diab stated: “ESG debt is an exciting trend – it is an innovative approach for corporates and markets to harness capital to drive ESG adoption and finance the energy transition for example. We expect this momentum to escalate rapidly given the demand for quality, ESG-compliant debt from institutional investors. Sustainability-linked bonds and loans have emerged as a new asset class and helped to spur this momentum of growth – they already reached 50% of total green bond sales within the last four years.”

Overall, across all asset classes, the role that regulation plays will be significant. In Europe, for instance, the ESG trend will continue to develop as asset managers comply with regulations such as the EU Taxonomy and SFDR to attract assets. BI forecasts ESG funds in Europe to double their market share with rebranded products making up half of ESG funds by 2025 – a growth spurred by client demand and an unprecedented level of product development. Scrutiny and requirements from regulators are increasing to address the risk of greenwashing.

The full ESG 2021 Midyear Outlook is available to Bloomberg Terminal subscribers via {BI<GO>}. Key findings of the report will be presented on a webinar on July 21, 2021. Registration details are available via the following link.

Contacts

Veronika Henze

Bloomberg Intelligence

+1-646-324-1596

vhenze@bloomberg.net

Samantha Boyd

Bloomberg Intelligence

+1-202-807-2150

sboyd49@bloomberg.net

About Bloomberg Intelligence

Bloomberg Intelligence (BI) research delivers an independent perspective providing interactive data and investment research on over 2,000 companies, 135 industries and all global markets. Our team of over 350 research professionals help our clients make decisions with confidence in the rapidly moving investment landscape. BI analysis is backed by live, transparent data from Bloomberg and 500 third-party data contributors that clients can use to refine and support their ideas. Bloomberg Intelligence is available exclusively on the Bloomberg Terminal and the Bloomberg Professional App. Visit us at https://www.bloomberg.com/professional/product/bloomberg-intelligence/ or request a demo.

About Bloomberg

Bloomberg, the global business and financial information and news leader, gives influential decision makers a critical edge by connecting them to a dynamic network of information, people and ideas. The company’s strength – delivering data, news and analytics through innovative technology, quickly and accurately – is at the core of the Bloomberg Terminal. Bloomberg’s enterprise solutions build on the company’s core strength: leveraging technology to allow customers to access, integrate, distribute and manage data and information across organizations more efficiently and effectively. For more information, visit Bloomberg.com/company or request a demo.